10 Best Online Payment Services for Small Businesses (2023)

Nowadays, more and more consumers feel at ease making payments online. When members, clients, or supporters are prepared to join, sign up for an event, or make a gift, they want to be able to do so swiftly and efficiently. It may be argued that websites that don’t accept online payments are out of date.

Small companies or startups may find the world of online payment services to be complicated, but all it really involves is making it simpler for your consumers to support you in a way that suits them. Here is the list of the 10 best online payment services for small businesses in 2023!

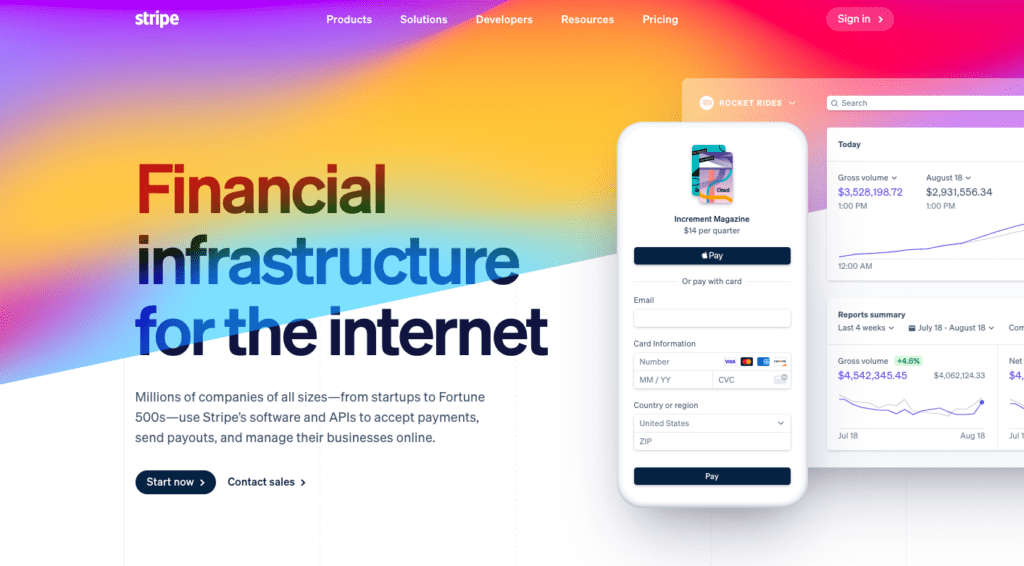

1. Stripe – 9.7/10

Merchants may take credit and debit cards as well as other forms of payment using Stripe, a supplier of payment services. Since most of Stripe Payments’ distinctive features are primarily designed for online sales, these companies are most equipped to use them.

Business owners may take debit cards, Visa, Mastercard, American Express, Discover, JCB, Diners Club, and China UnionPay, thanks to Stripe’s payment processing services. Businesses can also take payments through purchase now, pay later programs, and mobile wallets. Stripe accepts multiple currencies for payments. We have been using Stripe for a long time and even though we tried other services, Stripe provides the best service.

Transaction Fees: Costs: 2.9% & $0.30 per Credit/Debit transaction + 0.4% per recurring payment

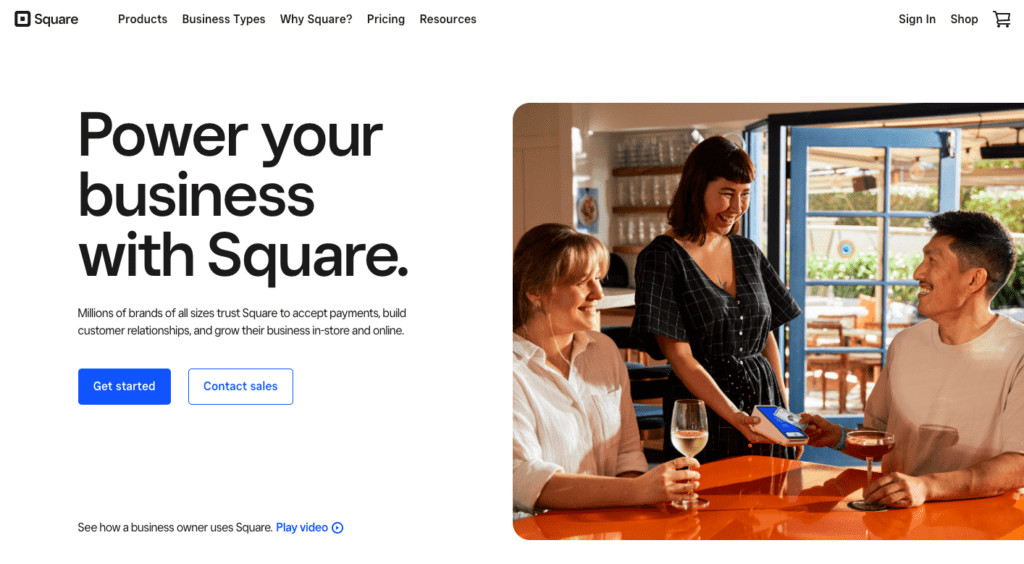

2. Square – 9.5/10

Practically everything a small business requires to run daily operations and sell products and services anywhere is provided by Square. Square offers a complete set of mobile, retail, and online sales tools as well as business management software, all in one convenient package. It also processes payments both offline and online.

There are no setup or ongoing costs to using all of Square’s features. The only expenses associated with utilizing Square for the majority of users are its clear, flat-rate processing fees. This can be connected to WooCommerce as well. If you are selling products online, this is a great tool for your small business!

Transaction Fees: 2.9% plus 30 cents or customized rates for large-volume businesses.

3. Payonner – 9/10

In addition to letting you make purchases online, Payoneer is a peer-to-peer payment system that also lets you send money to anybody in the globe. You receive a pre-paid Mastercard from it, which you may use anyplace that accepts Mastercard.

We used this service before and were generally happy with it. Although the service is beneficial, there are other, more advantageous solutions if you have a small business. Being able to submit payment requests to clients and have them pay you directly through the app is something I enjoy about it from a professional standpoint.

Transaction Fees: $0 for payments from other Payoneer users; 3% for credits card users

4. PayPal – 8.8/10

Using online money transfers, PayPal is a payment platform that offers a website and a mobile app. Customers of PayPal register for an account and link their credit card, bank account, or both.

Users can use PayPal as a middleman to send or receive payments in-person or online after verifying their identification and financial verification. Online and offline, PayPal payments are accepted by millions of small and major merchants. If you have the Paypal mobile app, it is really useful because you can manage everything on your phone for your small business.

Transaction Fees: 2.9% + $0.30 per Credit/Debit processing

5. DUE – 8.5

Due is a feature-rich payment processor fit for the demands of the twenty-first century. Users get access to secure transactions, virtual wallets, and even time-tracking software through Due. Due is a fantastic option if you’re searching for a comprehensive solution with various payment methods.

If your business has transactions with other businesses (B2B), Due is a great tool for you! It will provide you with money-saving tips and give you advice on how to improve your company financially.

Transaction Fees: 2.8% + 2.9% & $0.30 per Credit/Debit

6. Gumroad – 8.5/10

Gumroad takes all of the most popular debit and credit card companies and digital wallets from Apple and Google. In contrast to the other choices on our list, the pricing is distinct in that you pay a flat fee of $0.30 for each transaction plus a percentage of your overall revenue.

When sales begin to occur, you can keep track of everything via a dashboard that displays sales, page visits, traffic sources, and geolocation. You may contact the customers listed on the Audience page later to ask for comments or just to talk if you choose. If you have your own products, this is a wonderful tool for your business. It helps increase experience as they purchase your products.

Transaction Fees: $0.30 + anywhere from 2.9% to 9% per transaction

7. Amazon Pay – 8.4/10

By integrating Amazon Payment flow into your site, you may make it simpler for current Amazon customers to complete their purchases, lowering friction and boosting conversion. Additionally, it promotes your shop as a reliable source thanks to its consumer protection features.

If the goods or services described and what is actually provided differ, customers may file disputes with Amazon. It’s important to remember that these claims’ success or failure will impact your performance rating. If you think your products can be on Amazon, you should definitely use this for your business!

Transaction Fees: 2.9% + $0.30 per U.S. transaction. Fees can vary depending on the location

8. ECOMMPAY – 8.2/10

ECOMMPAY is a complete finance ecosystem that enables international online payments and payouts. The platform offers access to direct acquiring, the most popular local payment options and currencies, a B2B bank, and much more.

Consulting services are also available for companies expanding into new regions. Enjoy all the advantages of a custom, in-house payment infrastructure created to meet your unique demands. If your business is an international company, you might want to check this service!

Transaction Fees: It depends on the country you have transactions with.

9. Authorize.net – 8/10

Business owners may use Authorize.net, a payment gateway service owned by Visa, to take credit cards and online payments. Authorize.net provides a gateway-only option or an all-in-one service that combines a merchant account with a payment gateway. Each has a monthly premium, and the combined plan’s transaction costs are comparable to those of rival plans.

All popular credit and debit cards, Apple Pay, PayPal, and electronic checks are all accepted by businesses that use Authorize.net. The business provides client service around-the-clock. If you really concern about the security and protection of your transaction, this is an amazing tool for your business!

Transaction Fees: $25 per month + 2.9% & $0.30 per processing

10. 2Checkout – 8/10

For companies who conduct online sales of tangible objects or digital commodities like software, 2Checkout (Verifone) serves as a platform. Although it stands out due to its ability to accept payments from around the world and its subscription billing features, its payment processing fees can be high when compared to domestic rates.

The solution is ideal for online retailers of digital products since it allows for the use of sophisticated subscription systems and supports international transactions. If you sell digital products globally, this can be a good option for your business.

Transaction Fees: 3.5% + $0.35 per sale

There are many online payment services for your business, we hope this helps you find a good one for your needs! Don’t forget to check 10 Best Software For Small Startup Businesses (2023)!